sales tax rate tucson az 85750

85750 Sales Tax Rate. What is the sales tax rate for the 85750 ZIP Code.

Do You Pay Sales Tax On A House In Az Az Flat Fee

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax.

. There is no applicable special tax. The estimated 2022 sales tax rate for 85750 is. - Tax Rates can have a big impact when Comparing Cost of Living.

There is no applicable. The 2018 United States Supreme Court decision in South Dakota v. The US average is 46.

3 beds 2 baths 1393 sq. Has impacted many state nexus laws and sales tax collection. Get rates tables What is the sales tax rate for the 85750 ZIP Code.

The estimated 2022 sales tax rate for zip code 85750 is 610. Income and Salaries for Catalina. There is no applicable special tax.

The estimated 2022 sales tax rate for 85750 is 61. The South Tucson Arizona sales tax is 1000 consisting of 560 Arizona state sales tax and 440 South Tucson local sales taxesThe local sales tax consists of a 050. Select the Arizona city from the list of popular cities below to see its current sales tax rate.

The County sales tax. Tucson Az 85750 tax liens available in AZ. Shop around and act fast on a.

This is the total of state county and city sales tax rates. - The Income Tax Rate for Catalina Foothills zip 85750 is 42. To review these changes visit our state.

Sales Tax Rate for. The latest sales tax rates for cities in Arizona AZ state. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250.

SOLD MAY 25 2022. Find the best deals on the market in Tucson Az 85750 and buy a property up to 50 percent below market value. Tucson AZ is in zip code 85750.

Zip code 85750 is located in Tucson Arizona and has a. The Arizona sales tax rate is currently. The minimum combined 2022 sales tax rate for Tucson Arizona is.

276000 Last Sold Price. Nearby homes similar to 7255 E Snyder Rd 8105 have recently sold between 250K to 350K at an average of 285 per square foot. 4937 N Valle Rd Tucson AZ 85750 313000 MLS 22206240 Fantastic 3 bedroom home in sought after Tucson location.

This includes the rates on the state county city and special levels. The estimated 2022 sales tax rate for zip code 85750 is 610. Zip code 85750 is located in Tucson Arizona and.

The current and Dec 2020 total local sales tax rate in Tucson AZ is 8700.

Arizona Voters Broadly Oppose Sales Tax On Digital Services Nfib

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Sales Tax Transaction Privilege Tax Queen Creek Az

State And Local Taxes In Arizona Lexology

Combining Sales Tax Rates Experts In Quickbooks Consulting Quickbooks Training By Accountants

4267 N Sabino Mountain Dr Tucson Az 85750 Mls 22204098 Zillow

Colorado Sales Tax Rate Rates Calculator Avalara

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Manage Sales Tax For Us Locales

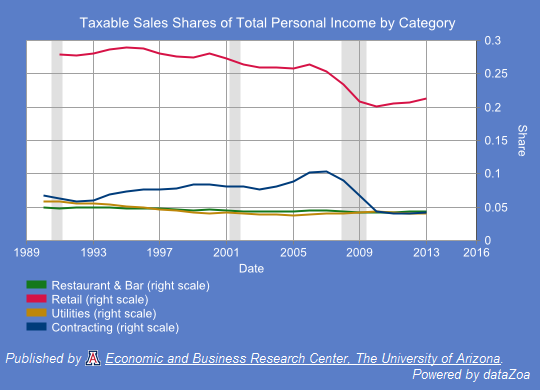

Arizona S Eroding Sales Tax Base Arizona S Economy

4601 N Paseo Tubutama Tucson Az 85750 Mls 22206314 Redfin

Arizona State Taxes 2021 Income And Sales Tax Rates Bankrate

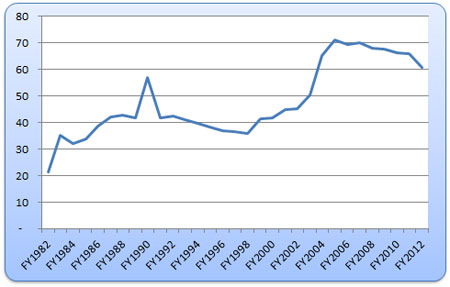

Arizona General Fund Tax Revenues An Historical Perspective Arizona S Economy

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

6144 E Finisterra Dr Tucson Az 85750 Mls 22223870 Redfin

5271 N Fort Yuma Trl Tucson Az 85750 Realtor Com